Unlock the White Home Watch e-newsletter at no cost

Your information to what Trump’s second time period means for Washington, enterprise and the world

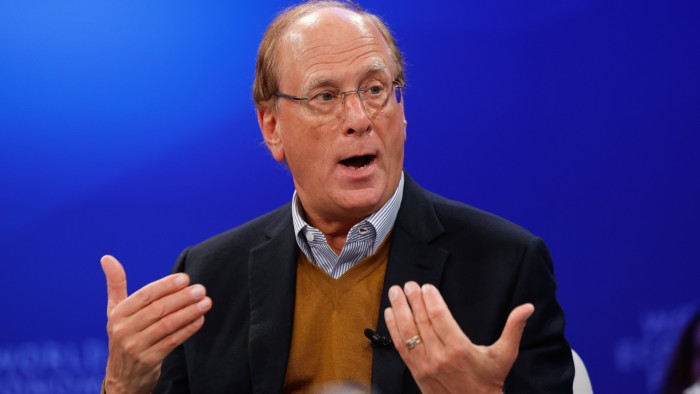

BlackRock chief govt Larry Fink stated the US was “going to hit the wall” until the financial system grows shortly sufficient to handle increased deficits from authorities spending, as a rising refrain of financiers warn concerning the nation’s mounting debt.

Fink, who leads the world’s largest asset supervisor, characterised the deficit as one of many “two most consequential points” US politicians are ignoring, as President Donald Trump seems to cross tax cuts that can add $2.4tn to the nationwide debt over the subsequent decade.

“We now have a pending tax invoice that is going so as to add $2.3tn, $2.4tn on the again of that,” Fink stated, pointing to the $36tn in current US debt. “If we don’t discover a method to develop at 3 per cent a 12 months . . . we’re going to hit the wall.”

“If we can not unlock the expansion and if we’re going to proceed to stumble alongside at a 2 per cent financial system, the deficits are going to overwhelm this nation,” Fink stated, talking at a Forbes convention in New York.

Talking on the similar convention, Citadel founder Ken Griffin stated the US’s “fiscal home just isn’t so as”.

“You can not run deficits of 6 or 7 per cent, at full employment, after years of progress,” he stated. “That’s simply fiscally irresponsible.”

US deficit spending has soared lately, and now stands at 120 per cent of GDP, in line with the Federal Reserve Financial institution of St Louis. The yield on the 30-year US sovereign bond has risen to its highest stage since late 2023 in latest weeks amid expectations of a flood of latest Treasuries in the marketplace.

Wall Road titans, together with JPMorgan CEO Jamie Dimon, have sounded the alarm in latest weeks concerning the prospects of upper deficit spending. Buyers have raised issues that the rising curiosity bills associated to the nation’s debt will overwhelm federal spending, which in flip will weigh on progress.

The concerns have mounted because the Republican Home of Representatives handed Trump’s “massive stunning invoice”, which might add $2.4tn to the deficit, in line with the unbiased Congressional Finances Workplace. The Senate is now deliberating the spending plan.

Whereas the Trump administration has promised to chop federal spending, these reductions are greater than offset by the extension of the president’s 2017 tax cuts.

The US has been on a unsustainable fiscal path for years, economists have argued. Giant federal spending programmes have been handed — notably after the Covid-19 disaster — whereas the federal government has lower taxes. Even earlier than the vote on Trump’s “massive stunning invoice”, the CBO projected that US debt as a share of GDP would rise above the excessive beforehand set through the second world conflict.

The extra the US borrows, the extra authorities debt the US has to promote to traders: the Treasury market has ballooned in dimension from about $5tn in 2008 to $29tn in the present day. Fink famous a glut of Treasury provide can be notably laborious for the market to digest in the intervening time, as Washington has alienated international traders with its tariff insurance policies.

“Importantly, 25 per cent of the US Treasury market is owned by foreigners,” Fink stated. “That’s not an excellent state of affairs once we are now battling many international locations associated to tariffs. And so that you’re beginning to start to see a weakening within the greenback.”