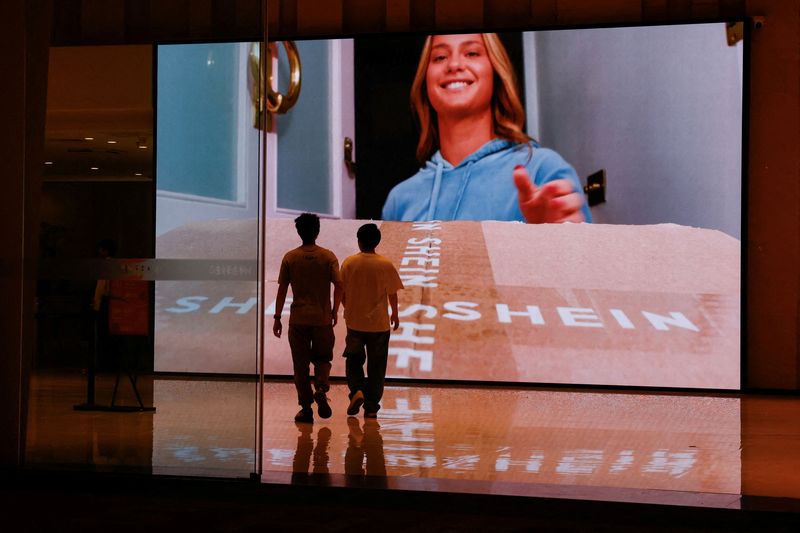

(Reuters) -Shein is working in the direction of a list in Hong Kong, as Chinese language regulators didn’t approve the web fast-fashion retailer’s proposed IPO in London, in keeping with three sources with data of the matter.

Here is a timeline of the Singapore-headquarted firm’s makes an attempt to go public and the assorted setbacks it has encountered.

Shein had moved its headquarters from China to Singapore in 2022, whereas its provide chains and warehouses largely stay in China.

JANUARY 2022

Shein revives plans to checklist in New York. Founder Chris Xu considers altering his citizenship to bypass proposed more durable guidelines for offshore IPOs in China, two sources informed Reuters.

It had first began getting ready for a U.S. IPO about two years previous to this however shelved the plan partly as a result of unpredictable markets amid rising U.S.-China tensions, sources informed Reuters.

FEBRUARY 2022

Shein places its U.S. itemizing plans on maintain as a result of risky capital markets amid Russia’s assault on Ukraine, sources say.

MARCH 2023

Shein was set to boost round $2 billion in a brand new funding spherical. The corporate was aiming for a U.S. itemizing within the second half of 2023, sources stated.

MAY 2023

A bipartisan group of two dozen U.S. representatives calls on the Securities and Alternate Fee to halt Shein’s IPO, till it verifies that Shein just isn’t utilizing pressured labor, in keeping with a letter seen by Reuters.

JUNE 2023

Shein makes strikes to register with regulators for an IPO in New York, individuals conversant in the matter stated.

JULY 2023

Shein was working with not less than three funding banks a few potential U.S. IPO and was in talks with the NYSE and Nasdaq, sources stated.

NOVEMBER 2023

Shein targets a valuation of as a lot as $90 billion for an eventual U.S. IPO, Bloomberg Information reported.

The style firm confidentially information to go public in the USA, in keeping with Reuters sources.

U.S. lawmakers as soon as once more demand proof that Shein’s $5 t-shirts and $10 sweaters weren’t being produced utilizing pressured labor.

DECEMBER 2023

Shein held talks with the London Inventory Alternate about the opportunity of a public itemizing in the UK, Sky Information reported, citing sources.

JANUARY 2024

Shein seeks Beijing’s nod to go public within the U.S. to adjust to new itemizing guidelines for native corporations, two sources informed Reuters.

FEBRUARY 2024

Republican Senator Marco Rubio asks the U.S. SEC to dam Shein’s New York itemizing bid until the corporate makes further disclosures about its enterprise operations and “the intense dangers of doing enterprise” in China.

Jeremy Hunt, British Finance Minister on the time, held talks with Shein’s Govt Chairman Donald Tang, and the fast-fashion chain is eager to checklist in London, a UK authorities supply informed Reuters.

MAY 2024

Shein steps up preparations for a London itemizing after its try and float itself in New York confronted regulatory hurdles and pushback from U.S. lawmakers, sources stated.

Shein plans to replace China’s securities regulator on the change of the IPO venue and file with the LSE as quickly as Could 2024, stated one in all them.

Senior British lawmakers, together with the chairs of three parliamentary committees, questioned Shein’s suitability for a London inventory market itemizing and known as for larger scrutiny of the Chinese language-founded agency.

JUNE 2024

Britain’s Labour Social gathering says it has met with Shein forward of a possible London-listing.

Shein confidentially information papers with Britain’s markets regulator in early June, two sources stated.

UK-based human rights group Cease Uyghur Genocide launches a authorized marketing campaign to dam Shein’s potential London itemizing.

JULY 2024

A brand new marketing campaign backed by British retail guide and tv character Mary Portas launches an internet petition calling on the brand new Labour authorities to dam Shein’s London itemizing.

OCTOBER 2024

Shein was set to carry casual investor conferences for its deliberate London IPO, sources stated.

DECEMBER 2024

Britain’s monetary regulator takes longer than regular to approve Shein’s IPO. It’s checking provide chain oversight and assessing authorized dangers after an advocacy group challenges the itemizing, sources report.

Shein considers asking UK regulators to waive itemizing guidelines that require not less than 10% of its shares to be offered to the general public in its deliberate IPO, sources stated.

JANUARY 2025

Shein goals to checklist in London within the first half of the yr, in keeping with two sources with direct data of the matter, assuming it features regulatory approvals.

Senior UK lawmaker flags considerations about Shein to LSE and regulator.

Shein tells UK lawmakers it doesn’t enable Chinese language cotton in merchandise offered within the U.S.

FEBRUARY 2025

Shein is ready to chop its valuation in a possible London IPO to round $50 billion, stated three sources, almost 1 / 4 lower than the corporate’s 2023 fundraising worth.

Shein’s London itemizing plans are more likely to be postponed to the second half of this yr after Donald Trump’s transfer to shut so-called “de minimis” guidelines, the Monetary Instances reported.

Shein is beneath stress to chop its valuation to about $30 billion forward of its London itemizing, Bloomberg Information reported.

APRIL 2025

Shein secures approval from Britain’s FCA for its deliberate London IPO, in keeping with two sources.

But in addition must safe approvals from Chinese language regulators, notably the CSRC, for the London float, sources have stated.

MAY 2025

Shein drops Brunswick and FGS, the 2 communications corporations supporting its push for a London IPO, a supply conversant in the matter confirms, within the newest signal that the flotation just isn’t going to plan.

(SOURCES: Reuters tales, different media)

(Compiled by Ankita Bora and Yadarisa Shabong in Bengaluru; Enhancing by Tasim Zahid)