Hailey Bieber attends the Rhode UK launch social gathering with Hailey Bieber at Chiltern Firehouse on Might 17, 2023 in London, England.

Dave Benett | Dave Benett Assortment | Getty Photographs

E.l.f. Magnificence introduced on Wednesday plans to amass Hailey Bieber’s magnificence model Rhode in a deal price as much as $1 billion because the cosmetics firm seems to increase additional into skincare.

The acquisition – E.l.f.’s largest ever, in line with FactSet – is comprised of $800 million in money and inventory, plus a further potential $200 million payout primarily based on Rhode’s efficiency over the subsequent three years. The deal is predicted to shut within the second quarter of the corporate’s fiscal 2026 — or later this 12 months.

“I have been within the shopper area 34 years, and I have been blown away by seeing this model over time. In lower than three years, they’ve gone from zero to $212 million in web gross sales, direct-to-consumer solely, with solely 10 merchandise. I did not suppose that was potential,” CEO Tarang Amin instructed CNBC in an interview. “In order that stage of disruption positively caught our consideration.”

In a information launch, Bieber mentioned she’s excited to companion with E.l.f. to carry her model to “extra faces, locations, and areas.”

“From day one, my imaginative and prescient for rhode has been to make important skincare and hybrid make-up you need to use daily,” mentioned Bieber. “Simply three years into this journey, our partnership with e.l.f. Magnificence marks an unimaginable alternative to raise and speed up our means to succeed in extra of our neighborhood with much more modern merchandise and widen our distribution globally.”

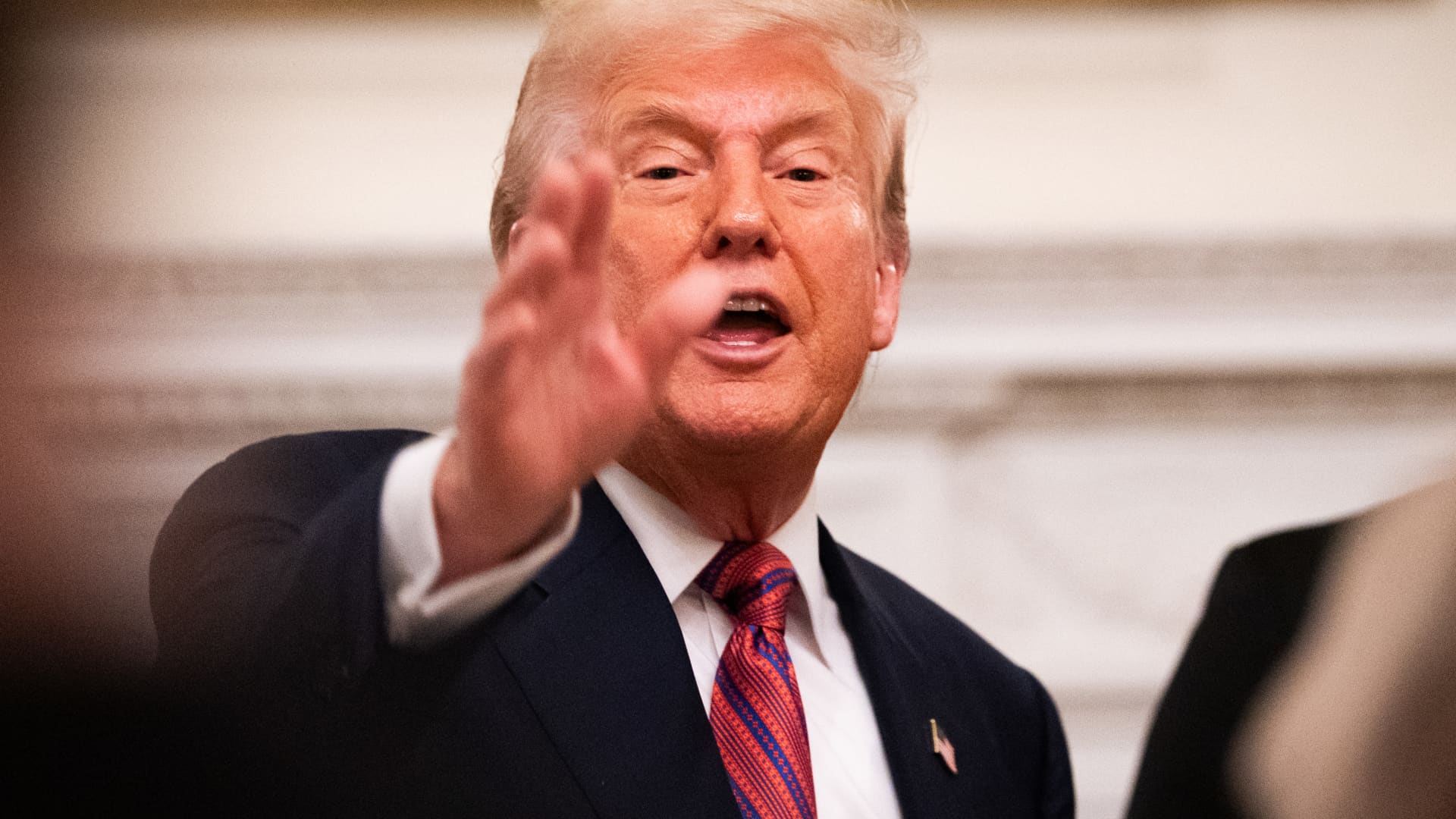

E.l.f. shares soared greater than 25% on Thursday after the corporate introduced the acquisition and launched outcomes for its fiscal fourth quarter. The corporate topped Wall Avenue’s quarterly estimates, however didn’t supply steerage because of the Trump administration’s altering tariff coverage. E.l.f. will get a disproportionate quantity of its merchandise from China.

In a word Thursday, Goldman Sachs analysts mentioned they see the Rhode deal “as a strategic constructive because it additional expands ELF into skincare with a status model, and diversifies its buyer base.”

“Whereas rhode is a DTC model, it is anticipated to be rolled out into retail, together with into Sephora, which we consider will additional assist development forward,” they added.

Why E.l.f. is betting on Rhode

Launched in 2022, Rhode has greater than doubled its buyer base over the previous 12 months and generated $212 million in income within the 12 months ended March 31. The corporate’s development has primarily come by way of its web site, nevertheless it plans to launch in Sephora shops all through North America and the U.Okay. earlier than the top of the 12 months.

As a part of the acquisition, Bieber will function Rhode’s chief inventive officer and head of innovation, overseeing inventive, product innovation and advertising and marketing. The model was launched alongside two co-founders, Michael and Lauren Ratner, nevertheless it was Bieber’s affect and title that turned it right into a billion-dollar model.

Below her route, Rhode final 12 months turned the No. 1 skincare model in earned media worth — or publicity by way of strategies apart from paid promoting — with 367% year-over-year development.

Rhode is a stable match for E.l.f., which has seen development skyrocket lately largely to its digital prowess. The corporate has legions of on-line followers and is understood for TikTok advertising and marketing that feels extra pure to customers.

The corporate can also be trying to dig deeper into skincare, which has turn out to be extra well-liked with all age teams, significantly E.l.f’s youthful, core shopper. In 2023, it acquired skincare model Naturium for $355 million. Its acquisition of Rhode will enable it to construct on its skincare development and attain a better revenue shopper.

“E.l.f. cosmetics is about $6.50 in its core entry worth level, Rhode, on common, is within the excessive 20s, so I might say it does carry us a unique shopper set to the corporate total, however the identical strategy by way of how we have interaction and entertain them,” mentioned Amin.

The deal is sensible for E.l.f., and it was a aggressive transfer to snag the model earlier than rivals did, nevertheless it comes at an unsure and tough time for the corporate. Even with anticipated worth will increase, China tariffs will seemingly cut back E.l.f.’s earnings over time, and it is funding $600 million of the cope with debt at a time of excessive rates of interest.

The acquisition is a wager that customers will hold spending on high-end skincare, even throughout a possible financial slowdown or recession.

E.l.f. beats earnings estimates

E.l.f. made the announcement because it posted fiscal fourth quarter outcomes, which beat Wall Avenue’s expectations on the highest and backside strains.

This is how the wonder retailer carried out in contrast with what Wall Avenue was anticipating, primarily based on a survey of analysts by LSEG:

- Earnings per share: 78 cents adjusted vs. 72 cents anticipated

- Income: $333 million vs. $328 million anticipated

The corporate’s reported web revenue for the three-month interval that ended March 31 was $28.3 million, or 49 cents per share, in contrast with $14.5 million, or 25 cents per share, a 12 months earlier. Gross sales rose to $332.7 million, up about 4% from $321.1 million.

E.l.f.’s gross sales have elevated quickly lately, however traders have grown involved as that development began to sluggish and the specter of tariffs started weighing on its enterprise. The corporate sources about 75% of its merchandise from China, which presently faces a 30% responsibility on exports to the U.S. Final week, it introduced plans to lift costs by $1 to offset larger prices from tariffs starting on Aug. 1.

Whereas U.S. duties on Chinese language imports are 30% now, that might change as President Donald Trump negotiates with Beijing. In consequence, E.l.f. mentioned it is not offering a fiscal 2026 outlook “because of the wide selection of potential outcomes associated to tariffs.”

Amin mentioned E.l.f. paid greater than 145% in duties earlier than Trump agreed to slash the levies on Chinese language items, however these prices did not come by way of throughout the quarter and can present up when the corporate stories its fiscal 2026 first-quarter earnings.