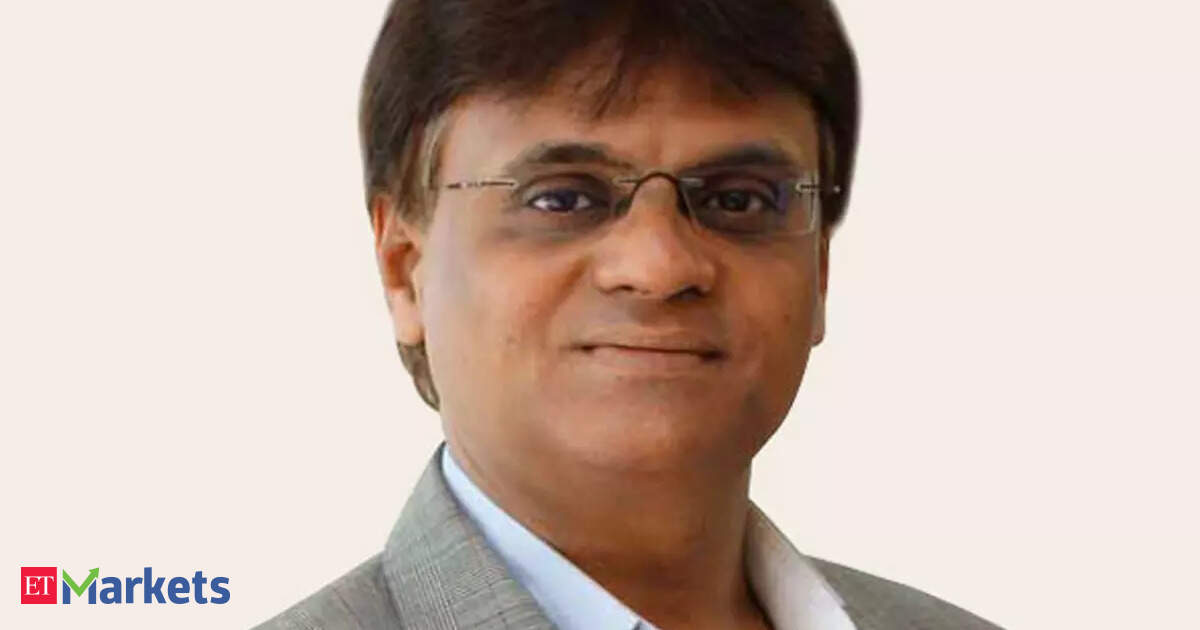

“This 12 months, now we have put a price range of round ₹2,000 crore on the IT aspect, in order that we’re capable of remodel the financial institution into a completely know-how and digital-driven financial institution. For FY25 additionally the price range was ₹2,000 crore, in opposition to which we spent 85%,” the financial institution’s MD Rajneesh Karnatak, instructed ET.

This quantities to just about 12% of Financial institution of India’s whole working expenditure however solely 2.5% of the entire revenue for FY25. The financial institution’s working expenditure jumped 13% YoY with cost-to-income ratio falling barely to round 51%.

Whereas Indian banks have enhanced IT budgets in recent times, it stays decrease in comparison with international friends. A report by Boston Consulting Group in August 2024 had mentioned that international banks sometimes make investments 7-9% of their income on IT methods, whereas Indian banks allocate solely as much as 5%.

Analysts say that public sector lenders are additionally seen lagging behind non-public friends in the case of technological adoption. Although Karnatak refuted this and mentioned {that a} massive differentiator between a personal financial institution and a public sector financial institution was there, say, 10 years in the past. It’s no extra the case and PSBs additionally very sturdy know-how and cyber safety platform.

Karnatak, who took cost because the financial institution’s chief in April 2023, has centered on a slew of digital initiatives with an intention to usher in extra enterprise in addition to obtain operational effectivity. For example, within the second half of FY25, Financial institution of India automated 16 processes, which helped the financial institution save practically 12,000 manhours. “We’re doing loads of automation of the duties, that are very routine.”The financial institution added 5,200,000 clients on its cellular banking utility within the earlier fiscal, taking the entire to 9 million.