Elon Musk says he desires to remain CEO of Tesla for not less than the following 5 years and have extra controlling shares within the firm.

It will probably seal Tesla’s destiny with Musk’s, as shareholders will possible approve of this regardless of his toxicity and lies.

As I wrote in my latest article, ‘The Tesla (TSLA) dilemma,’ the corporate is completed if it stays connected to Elon Musk’s toxicity, however the inventory will undoubtedly crash if he leaves, as the present valuation is solely based mostly on shareholders believing in his stock-pumping claims about self-driving automobiles and robots.

Musk created the present scenario at Tesla, which he pushed to go all-in on autonomy regardless of his being incorrect about Tesla fixing autonomy for years. Within the meantime, Tesla has launched a single new automobile during the last 5 years, the Cybertruck, and it’s a flop.

His backing of divisive politics, rapprochement with Russia, and fixed promotion of confirmed misinformation on social media have resulted in Musk being despised by nearly all of the inhabitants, particularly Tesla’s buyer base.

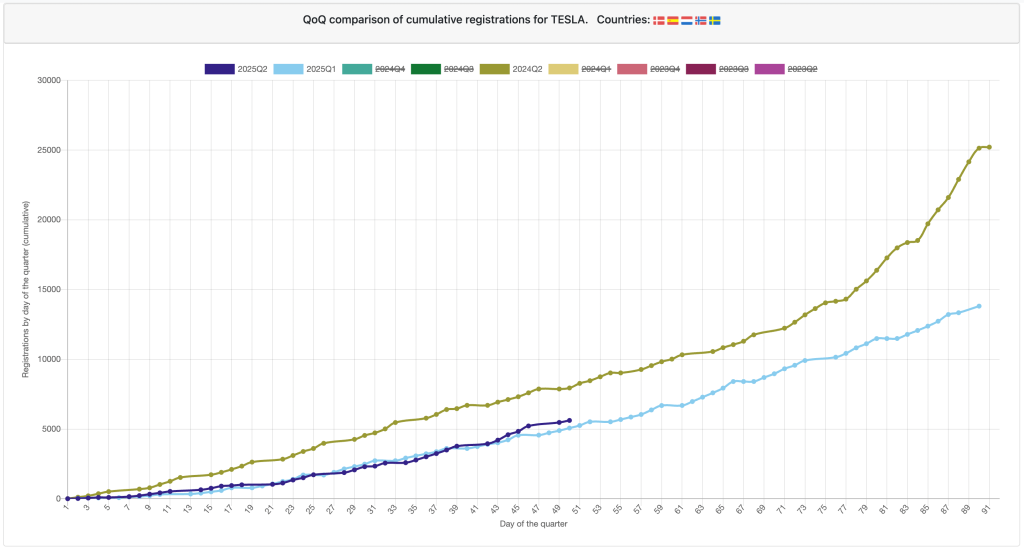

The toxicity of Musk’s model has leaked to Tesla and the corporate has been in a transparent decline. Tesla’s automobile gross sales have been down for the primary time in 2024 and the decline is accelerating in 2025.

Tesla’s gross sales have been down by about 50,000 items within the first quarter of 2025, and they’re monitoring equally within the second quarter.

Right this moment, on the Qatar Financial Discussion board hosted by Bloomberg, Musk denied the scenario solely.

He mentioned (by way of AP):

When questioned about Tesla’s weakening gross sales within the first quarter and April gross sales up to now in Europe, Musk mentioned the enterprise has “already circled,” including that “Europe is our weakest market” and that Tesla was “sturdy in every single place else.”

It is a lie.

Tesla’s gross sales in China in Q2 2025 are monitoring about 10,000 items beneath the identical interval in 2024, regardless of document incentives and the brand new Mannequin Y being in quantity manufacturing.

Within the US, information is extra opaque, however Tesla is estimated to be down out there regardless of providing extra reductions than ever.

Europe is certainly Tesla’s weakest market, however there’s no signal that it has “already circled” as Musk claims.

Regardless of having the brand new Mannequin Y accessible in Q2, gross sales are method down in comparison with final 12 months, and it’s monitoring equally to Q1 2025, which was a catastrophe and Tesla blamed it on the Mannequin Y changeover:

It gained’t have the ability to blame the Mannequin Y in Q2 and can want one other clarification for the poor gross sales efficiency in Europe. Tesla can be providing 0% financing at a excessive price in most European markets to counter this clear decline in demand.

As an alternative of this tough information, Musk backed his lies by claiming that Tesla’s present excessive inventory worth proves that the enterprise is nice:

Musk mentioned the market is the final word scorecard for Tesla’s state of enterprise. “[Tesla] inventory wouldn’t be buying and selling close to all-time highs” if the enterprise was struggling, he mentioned. Whereas Tesla inventory has recovered this 12 months, it nonetheless down 13% 12 months so far and off 30% from its all-time excessive.

The inventory worth is barely up as a result of extra individuals are shopping for shares than promoting them, they usually might be shopping for them for a lot of causes that don’t have anything to do with Tesla’s enterprise doing effectively.

Musk himself has beforehand mentioned that Tesla’s inventory is “value nothing” if the corporate can’t remedy autonomy, which connected plenty of Tesla’s valuation to autonomous driving. Many Tesla traders are merely holding on to Musk’s claims that Tesla is on the verge of fixing autonomy – regardless of him saying it might occur by the tip of yearly since 2019.

The CEO was then requested if he was dedicated to staying as head of Tesla for the following 5 years, to which he answered ‘sure’.

However he mentioned that he would want extra shares in Tesla.

Musk claimed that it wasn’t about cash however management over the corporate:

“I can’t be sitting there and questioning if I’m going to be tossed out. “Now let’s transfer on.”

Tesla shareholders are at present suing the CEO over threatening them to not construct AI merchandise at Tesla if he doesn’t get extra management, by means of shares, within the firm.

Electrek’s Take

Blatant lies. Now we have the information. We all know Tesla’s gross sales are down in nearly all markets. To counter the declining demand, Tesla is providing document reductions and incentives in most markets.

We all know Tesla doesn’t try this with sturdy demand. The automaker is at present throttling down manufacturing and providing reductions. Does that sound just like the demand is nice? No.

I say that he’s sealing Tesla’s destiny by saying that he’ll stay CEO as a result of Tesla shareholders will probably approve of this. They know the inventory worth will tumble with out his “company puffery.” They’re OK with letting Tesla’s EV enterprise soften only for the hope that he would possibly lastly be proper about autonomy and Tesla would possibly see gentle on the finish of the tunnel and justify its $1 trillion valuation.

That’s a fallacy.

Elon and Tesla have been incorrect about unsupervised autonomy engaged on HW2.5. They have been incorrect about it engaged on HW3.0. And so they have been extra possible than not incorrect about it engaged on HW4.

They’ve made some spectacular progress, they usually would possibly ultimately make it work at scale on HW5 within the subsequent few years. Nevertheless, by then, there will probably be loads of competitors, and Tesla is already behind opponents like Waymo, which is already accessible in a number of markets and offers a whole lot of 1000’s of paid rides each week.

Along with the competitors, Tesla will even have an enormous legal responsibility for promising unsupervised self-driving on thousands and thousands of autos produced since 2016 and never with the ability to ship on this promise.

All of that whereas its core EV enterprise is declining.

FTC: We use earnings incomes auto affiliate hyperlinks. Extra.