Elon Musk simply made public and materials lies aimed toward Tesla shareholders. Right here’s the proof with the related transcript.

Now, let’s see if the SEC nonetheless has enamel or if the US has absolutely entered its rip-off period below the Trump administration.

Right now, Musk made false statements aimed toward Tesla shareholders and straight addressed the inventory worth.

Right here’s the video, transcript, and related data that proves Musk was mendacity:

Tesla gross sales are robust all over the place however Europe

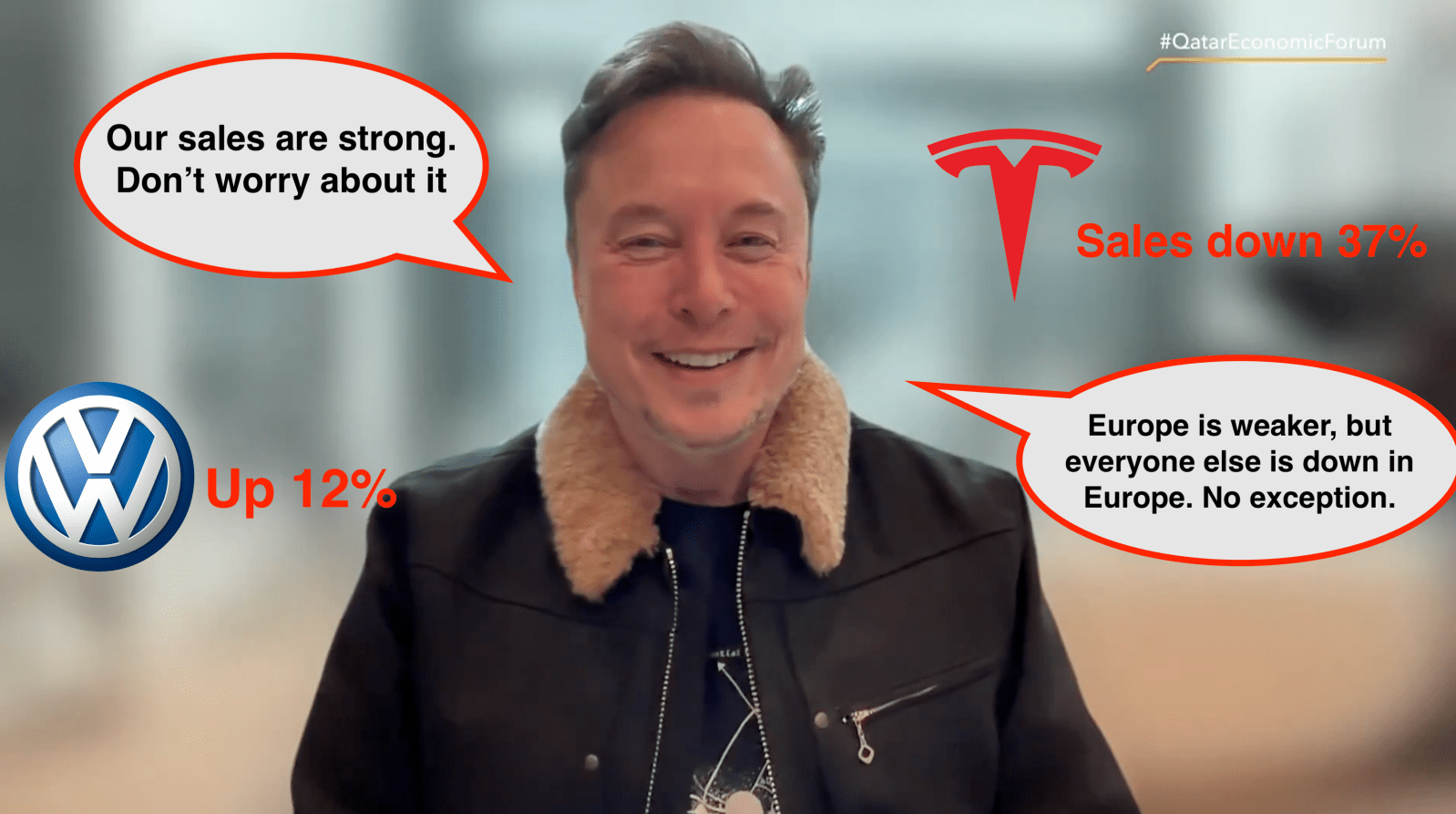

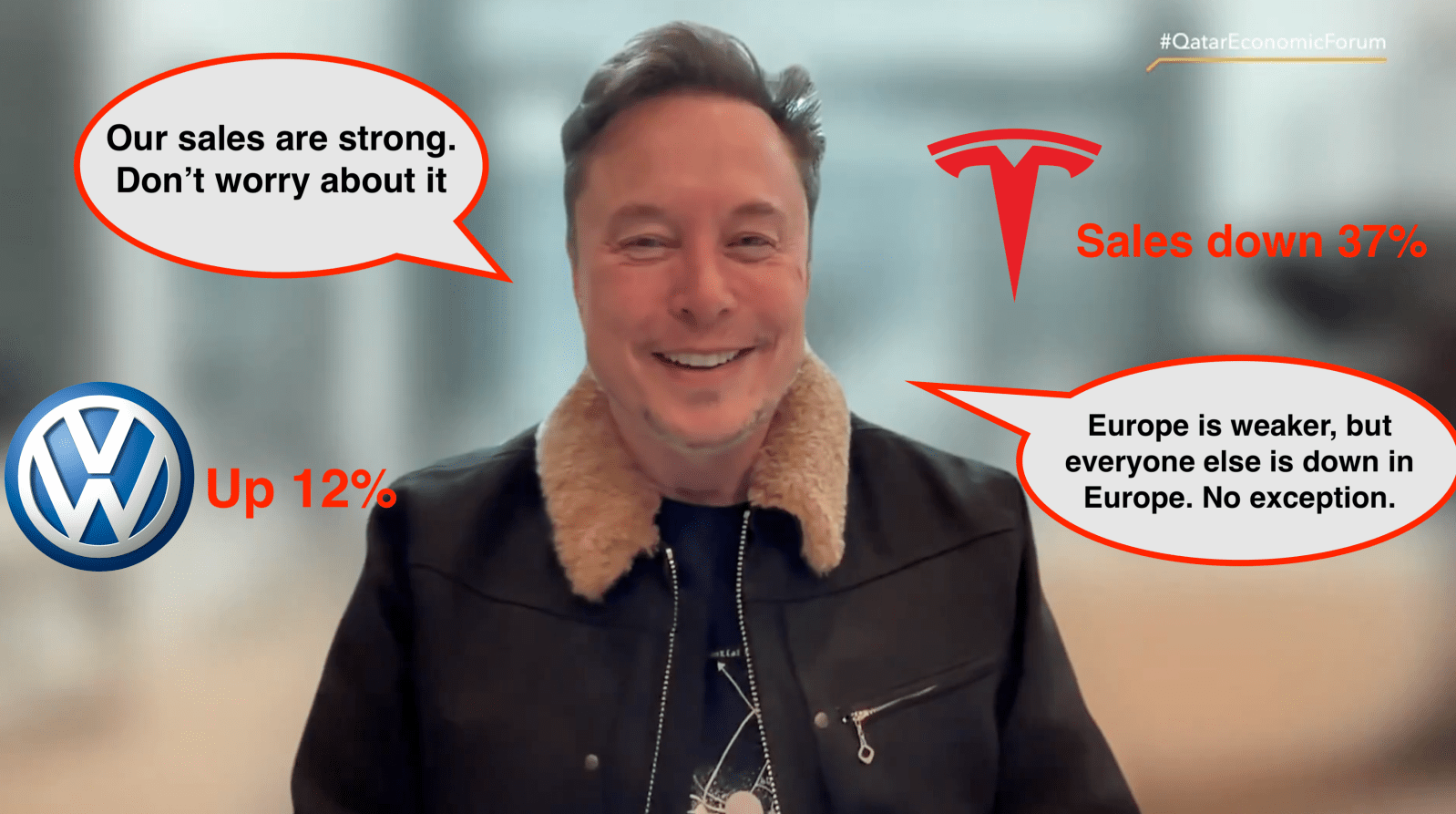

The CEO began the phase by claiming this:

Europe is our weakest market. We’re robust all over the place else. Our gross sales are doing very properly at this level. We don’t count on any significant gross sales shortfall.

Tesla’s weakest market is Europe, however gross sales are usually not “robust all over the place else.”

We’ve up-to-date knowledge from China as much as final week, and Tesla is having its worst efficiency in years within the vital EV market:

That is Tesla’s worst quarter begin within the final two years based mostly on the insurance coverage registration knowledge. It’s already confirmed that Q1 2025 gross sales had been horrible all over the place, however up-to-date knowledge in Europe and China verify that Tesla continues to be struggling in China and Europe.

That’s additionally regardless of Tesla providing extra incentives and reductions in China than ever. Mannequin 3 and Mannequin Y, representing over 95% of Tesla’s gross sales in China, are at present provided with 0% financing at Tesla’s value.

When pressed about Tesla’s gross sales nonetheless being down in Europe, Musk answered:

Sure, that’s true of all producers. There’s no exception. The European market is kind of weak.

It’s a bummer that the host didn’t push again on this as a result of it’s a blatant lie.

The European Vehicle Producers’ Affiliation (ACEA) launched the information a number of weeks in the past.

Within the EU, EFTA, and the UK, Tesla’s gross sales had been down 37% in Q1 2025. It’s true that different automakers had been additionally down, however not “all producers” and definitely loads of “exceptions”:

As you’ll be able to see, the Volkswagen Group was up 5% as an entire and the VW model itself was greater than 12% within the first quarter.

Renault and BMW had been additionally up, as was SAIC.

The lie is much more blatant while you solely have a look at the EV market, the place Tesla operates. Battery electrical automotive gross sales surged nearly 24% in Europe within the first quarter, whereas Tesla’s gross sales dropped 37%.

Now, this was the final quarter. Perhaps Musk may get away by claiming the turnaround is occurring now or different automakers are actually struggling in Q2.

Nevertheless, that is additionally not true based mostly on the newest up-to-date knowledge.

A number of European markets report every day car registrations and based mostly on this knowledge, Tesla (left) is monitoring means behind the identical interval final 12 months and about the identical as its horrible Q1 2025, whereas VW (proper) is at present considerably outperforming proper now in comparison with the final quarter or the identical interval in 2024:

That is additionally true of BMW, Ford, Hyundai-Kia, and a number of other different automakers. So Musk’s declare of no exception isn’t even remotely true.

The inventory market confirms Tesla is doing nice

Musk used Tesla’s inventory worth as some type of proof of what he’s claiming:

Clearly, the inventory market acknowledges that since we’re again now at over $1 trillion market cap. Clearly the market is conscious of the state of affairs. It’s already circled.

It is a deceptive assertion. The inventory worth is by no means consultant of Tesla’s gross sales. Musk has admitted that previously. He stated that “Tesla was price nothing” if it didn’t clear up self-driving.

The inventory is totally disconnected from Tesla’s car enterprise.

Extra particularly, Musk can also be unsuitable to assert that the market is “conscious of the state of affairs.”

Final quarter, Wall Road analysts had been attempting to trace Tesla’s gross sales, however they missed badly.

For a lot of the quarter, Wall Road believed Tesla would ship greater than 400,000 automobiles and solely began to replace their estimates means down towards the second half of the quarter.

Even then, they nonetheless ended up overestimating Tesla’s deliveries by 40,000 models.

Subsequently, it’s clear that the market isn’t properly “conscious” of Tesla’s present gross sales ranges. The identical factor is occurring in Q2 2025. The present Wall Road consensus is that Tesla will ship about 420,000 automobiles in Q2 2025 when the very best knowledge obtainable present that Tesla is monitoring beneath Q1 2025, when the automaker delivered 336,000 automobiles.

There’s nonetheless a month to go within the quarter, however it’s unlikely that Tesla will be capable of speed up deliveries sufficient to succeed in over 400,000 models.

Afterward within the phase of the interview embedded above, Musk once more referenced the inventory worth:

Once more, you’ll be able to simply have a look at the inventory worth. If you’d like the very best inside data, the inventory market analysts have that and our inventory wouldn’t be buying and selling close to all-time highs if issues weren’t in fine condition. They’re tremendous. Don’t fear about it.

Once more, we now have clear knowledge that present that “inventory market analysts” are horrible at monitoring Tesla’s gross sales, and the inventory worth is by no means consultant of an organization’s present efficiency.

It’s merely consultant of the demand for Tesla’s inventory, which Musk himself admits is linked to Tesla’s autonomous driving effort.

Gross sales numbers are robust, no drawback with demand

When pushed again on the demand entrance, Musk added:

The gross sales numbers are robust. And we see no drawback with demand.

That is one other lie. On high of the beforehand mentioned declining gross sales, it’s price mentioning that these declines are in comparison with 2024, a 12 months when Tesla noticed its first full-year decline in gross sales since beginning quantity car manufacturing a decade in the past.

In 2024 and now into 2025, Tesla has throttled down its manufacturing capability to about 60% of its general capability attributable to low demand.

Even with fewer automobiles obtainable, Tesla is now providing file reductions and backed financing charges at an ideal value to the corporate – clear indicators of demand issues.

The place is the SEC?

These are clear, verifiable, and materials lies aimed toward Tesla shareholders. It’s a safety violation that the SEC must be going after.

This might be an ideal check of how corrupt federal companies are below the Trump administration.

The lies are verifiable proper now, however I wouldn’t be shocked in the event that they wait till Tesla reviews its official deliveries for Q2 2025.

If they’re considerably down versus Q2 2024, as anticipated, it will be straightforward to show that Musk was deceptive shareholders with these claims immediately.

What are the chances on the SEC really going after this or letting it slide?

FTC: We use revenue incomes auto affiliate hyperlinks. Extra.