Sony’s international music rights operation – throughout recorded music and music publishing – generated USD $2.54 billion within the three months to finish of March 2025.

That’s based on MBW’s calculations based mostly on Sony Group Corp’s calendar Q1 2025 (fiscal This fall 2024) outcomes, as introduced by the Japanese agency at the moment (Might 14).

The $2.54 billion determine was up by 1.5% year-on-year (vs. calendar Q1 2024) at US dollar-converted constant forex.

In financial phrases, Sony’s general music rights operation (recorded music plus music publishing) generated roughly $37 million extra in calendar Q1 2025 than within the prior-year quarter.

(As common MBW readers will know, our calculations of Sony’s music earnings – defined on the backside of this story – are based mostly on common quarterly trade charges, offered by Sony, from its reported Yen to USD. We imagine this provides a extra correct image of Sony’s worldwide outcomes than its reported Yen figures. It is because Sony Music Leisure and Sony Music Publishing each mixture the outcomes of their worldwide subsidiaries on a USD foundation. Nonetheless, this international USD conversion system dangers a specific amount of FX distortion by changing revenues from Tokyo-based Sony Music Leisure Japan – which might often report revenues in its ‘root’ forex of Yen – into USD. This ought to be flagged as it will probably affect YoY comparisons.)

Importantly, this newest quarterly set of outcomes additionally represents the shut of Sony Group Corp’s FY (to finish of March), enabling the agency to mission forward over the subsequent 12 months (to finish of March, 2026).

In its supplies for buyers at the moment, Sony stated that it expects Sony Music Group‘s annual working revenue within the 12 months to finish of March subsequent yr to develop “within the excessive single digits on a US greenback foundation”.

(Sony Music Group represents the mixed international operations of Sony Music Leisure and Sony Music Publishing, however not Sony Music Japan.)

Recorded music income breakdown

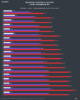

Sony’s international recorded music operation generated USD $1.91 billion in calendar Q1 2025, down 1.8% YoY versus the equal quarterly interval of the prior yr on a USD foundation. (Sony reported recorded music in calendar Q1 on a Yen foundation was up by roughly 1% YoY.)

As you’ll see, a lot of this YoY decline may be attributed to a lower in Sony’s ‘Different’ gross sales – together with merch and dwell tickets – slightly than its revenues from streaming or bodily music.

Inside Sony’s calendar Q1 2025 international recorded music consequence, streaming generated USD $1.27 billion (on a USD-converted foundation), up 1.8% YoY.

(This ‘streaming’ quantity combines each subscription and ad-funded streaming revenues generated by Sony’s international recorded music operation.)

Quarterly revenues from bodily music gross sales in calendar Q1 2025 hit USD $176 million (up 8.8% YoY).

Sony’s ‘Different’ fiscal class inside recorded music generated $418.4 million in calendar Q1 2025, down 12.2% YoY vs. the $476.6 million generated within the prior-year quarter.

This latter class (‘Different’) contains license income (public efficiency, broadcast and sync), merchandising, and dwell efficiency revenue.

Clearly, these classes – notably dwell and merch – can expertise seasonal differences.

Value noting, then, that the +$22 million YoY soar in quarterly recorded music streaming income Sony posted in calendar Q1 2025 was greater than offset by a -$58 million YoY drop in ‘Different’ gross sales.

Prime-selling initiatives globally

In line with Sony Corp‘s outcomes, Sony Music Leisure’s ten largest recorded music initiatives within the calendar Q1 2025 quarter (ex-artists signed in Japan), so as of world income era, had been:

- SZA – SOS Deluxe: LANA

- Tate McRae – So Near What

- LISA – Alter Ego

- Tyler, The Creator – CHROMAKOPIA

- Tyler, The Creator – IGOR

- Travis Scott – UTOPIA

- Central Cee – CAN’T RUSH GREATNESS

- Rauw Alejandro – Cosa Nuestra

- JENNIE – Ruby

- Michael Jackson – Thriller

Sony Music Leisure’s ten largest recorded music initiatives within the fiscal yr to finish of March 2025 (ex-artists signed in Japan), so as of world income era, had been:

- SZA – SOS Deluxe: LANA

- Beyoncé – COWBOY CARTER

- Future & Metro Boomin – WE STILL DON’T TRUST YOU

- Travis Scott – UTOPIA

- Tyler, The Creator – CHROMAKOPIA

- Michael Jackson – Thriller

- Tyler, The Creator – IGOR

- Luke Combs – This One’s For You

- ATEEZ – GOLDEN HOUR : Half.2

- Tate McRae – THINK LATER

Music publishing efficiency

Sony’s international music publishing operation – led by Sony Music Publishing – generated USD $630.9 million within the three months to finish of March 2025.

That quarterly income determine, on the US greenback stage, was up 12.9% year-on-year.

Sony’s international music publishing operation derived $363.4 million of its quarterly revenues within the calendar Q1 2025 interval from streaming.

That publishing streaming determine was up 22.0% year-on-year.

Quarterly earnings

Sony Corp additionally at the moment issued some revenue numbers for its company Music division within the three months to finish of March 2025. (The next figures embody Sony’s operations throughout Recorded Music, Music Publishing plus Visible Media & Platform.)

In calendar Q1 2025 (fiscal This fall 2024), Sony’s company Music division posted a quarterly working revenue of 83.6 billion Yen (USD $548m).

That represented an working margin of 17.8%, from complete divisional quarterly revenues (once more, ‘Music’ together with ‘Visible Media & Platform’) of 470.7 billion Yen (USD $3.08bn).

Full fiscal yr outcomes

As talked about, at the moment’s calendar Q1 outcomes from Sony had been additionally the agency’s fiscal This fall outcomes – that means additionally they encompassed Sony’s FY outcomes for the yr to finish of March 2025.

Inside these FY outcomes, Sony revealed the full-year revenue figures for its Music division. (Once more, on this context, this contains Sony’s operations throughout Recorded Music, Music Publishing, plus ‘Visible Media & Platform’. Nonetheless, ‘Visible Media & Platform’ solely makes up round 10% of Sony’s annual revenue in its Music division.)

In FY 2024 (12 months to finish of March 2025), Sony’s company Music division posted an annual working revenue of 357.3 Yen (USD $2.34bn).

That represented an working margin of 19.0%, from complete divisional FY revenues (once more, ‘Music’ together with ‘Visible Media & Platform’) of 1.843 trillion Yen (USD $12.09bn).

Methodology observe

Notice: All YoY share rises/falls revealed on this story are calculated at fixed forex on the US dollar-converted stage. MBW makes use of Sony’s personal quarterly common forex charges for these calculations.

See beneath for the breakdown of Sony’s newest (fiscal) quarterly figures for music in Japanese Yen, as revealed by Sony Group Corp at the moment.

For this evaluation, MBW has calculated Sony’s financials from Japanese Yen into US {dollars} on the following prevailing trade charges in every quarter, as offered by Sony Corp:

- Calendar Q1 2020: 109.0 Yen per USD

- Calendar Q2 2020: 107.6 Yen per USD

- Calendar Q3 2020: 106.2 Yen per USD

- Calendar This fall 2020: 104.5 Yen per USD

- Calendar Q1 2021: 105.9 Yen per USD

- Calendar Q2 2021: 109.5 Yen per USD

- Calendar Q3 2021: 110.1 Yen per USD

- Calendar This fall 2021: 113.7 Yen per USD

- Calendar Q1 2022: 116.1 Yen per USD

- Calendar Q2 2022: 129.4 Yen per USD

- Calendar Q3 2022: 138.2 Yen per USD

- Calendar This fall 2022: 132.3 Yen per USD

- Calendar Q1 2023: 135.4 Yen per USD

- Calendar Q2 2023: 137.0 Yen per USD

- Calendar Q3 2023: 144.4 Yen per USD

- Calendar This fall 2023: 147.9 Yen per USD

- Calendar Q1 2024: 148.2 Yen per USD

- Calendar Q2 2024: 155.6 Yen per USD

- Calendar Q3 2024: 149.5 Yen per USD

- Calendar This fall 2024: 152.2 Yen per USD

- Calendar Q1 2025: 152.6 Yen per USD

By making use of these trade figures to every relevant interval, we successfully get a US-leaning fixed forex image of Sony Music’s efficiency.

This isn’t an ideal system; it dangers overplaying Sony Music Leisure’s international enterprise barely by changing a piece of revenues from Sony Music Leisure Japan (which might often be straight-reported in Yen) into US {dollars}.

Nevertheless it gives us with a cleaner reflection of the efficiency of New York-based Sony Music Leisure outdoors of FX distortion, as a result of the corporate needed to convert its US forex into Yen within the first place for Sony Corp’s outcomes. The identical is true for US-based Sony Music Publishing.

MBW believes this forex trade system is the yardstick used internally at Sony Music Group‘s HQ in New York.

Sony’s personal description of its three company music divisions is as follows:

- Recorded Music – Streaming contains the distribution of digital recorded music by streaming; Recorded Music – Others contains the distribution of recorded music by bodily media and digital obtain in addition to income derived from artists’ dwell performances;

- Music Publishing includes the administration and licensing of the phrases and music of songs;

- Visible Media and Platform contains the manufacturing and distribution of animation titles, together with recreation purposes based mostly on the animation titles, and varied service choices for music and visible merchandise.

Inside / protecting the primary two divisions listed above:

- Sony Music Publishing, run by CEO & Chairman Jon Platt, is Sony’s US-headquartered music publishing operation.

- Sony Music Leisure, run by CEO Rob Stringer, is Sony’s US-headquartered recorded music operation.

- And Sony Music Group – additionally run by Rob Stringer, as Chairman – is Sony’s US-headquartered umbrella group for each Sony Music Leisure and Sony Music Publishing.

Music Enterprise Worldwide