MEHUL KOTHARI

AVP – TECHNICAL RESEARCH, ANAND RATHI SHARES & STOCK BROKERS

The place is Nifty headed this week?

Nifty’s current correction was broadly anticipated. Whereas the autumn itself wasn’t a shock, the geopolitical set off provides a layer of concern. Technically, the index has fashioned a bearish engulfing sample on weekly chart, suggesting extra draw back except it reclaims 24,500. Within the brief time period, 23,800 acts as instant help, adopted by 23,500, which aligns with the 200-EMA. If these ranges are breached, the bearish momentum could intensify. On the flip aspect, if Nifty strikes above 24,500 and Financial institution Nifty reclaims 55,000, the broader pattern may stabilise, providing a short-term reduction rally. Till then, volatility could persist.

What may traders do?

With each Nifty and Financial institution Nifty testing important help, merchants ought to stay cautious. Lengthy positions are solely advisable above 24,500 in Nifty and 55,000 in Financial institution Nifty, with protecting places. Quick trades could also be thought-about on a break under 23,800, concentrating on 23,500 and decrease, whereas Financial institution Nifty shorts could eye 52,600 if 53,500 breaks. Traders can contemplate staggered accumulation close to Nifty at 23,500 and Financial institution Nifty at 51,800–52,600, however ought to enhance publicity solely on clear power above key resistances.

SACCHITANAND UTTEKAR

VP-TECHNICAL & DERIVATIVES, TRADEBULLS SECURITIES

The place is Nifty headed?

Nifty seems to be coming into a section of time and worth correction, with the index now struggling to decisively surpass the important thing resistance degree of 24,545. This week marks the primary shut under current weekly swing low of 24,008, signalling potential short-term weak point, though the index nonetheless managed to carry above its 5-week EMA help at 23,860. Development power indicators akin to ADX falling under 18 and RSI heading towards the impartial 50 mark additional help the chance of an ongoing corrective section.

What may traders do?

For momentum merchants, it’s advisable to keep away from chasing breakouts and as a substitute look forward to a confirmed shut above 24,545. Ought to the continuing correction deepens, traders can view it as a staggered accumulation alternative. Key help ranges to look at embody the 20-week EMA close to 23,540 and the 22,900 zone, which represents a important weekly help. These ranges are more likely to uphold the broader bullish construction. High picks are ICICI Financial institution, Kotak Financial institution, Dwelling First Finance, SBI, HUL, BEL, SRF, Nykaa, Samvardhana Motherson, and Titan

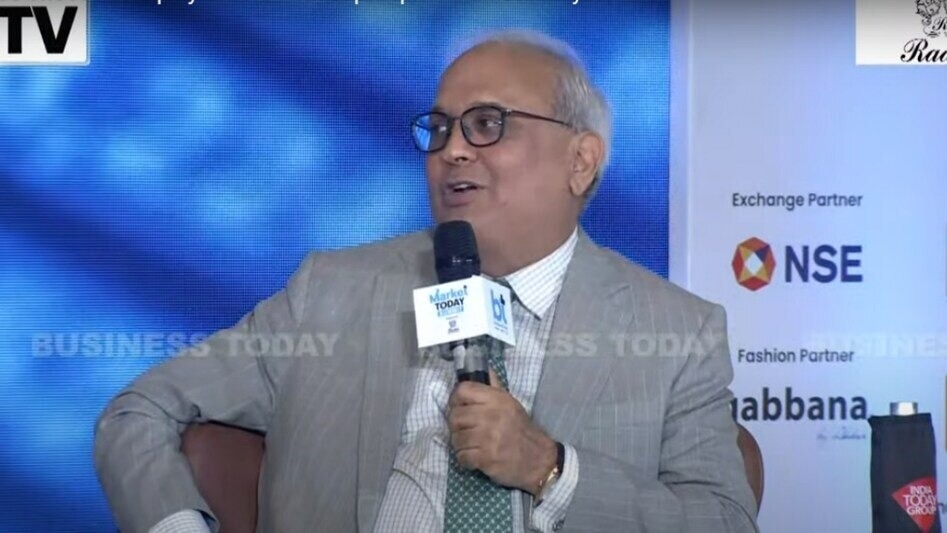

DHARMESH SHAH

HEAD OF TECHNICAL, ICICI SECURITIES

The place is Nifty headed this week?

Nifty snapped a three-week profitable streak monitoring escalated geopolitical rigidity and settled the unstable week at 24,008, down 1.4%. The heightened geopolitical rigidity fuelled the volatility out there. We anticipate Nifty to consolidate within the broader vary of 24,500- 23,200, whereby stock-specific motion would prevail amid the continuing earnings season. In the meantime, the de-escalation of armed battle can be the important thing monitorable as it might open the door for the subsequent leg of up-move.

What ought to traders do?

We advise to not panic however relatively construct high quality portfolios from a medium-term perspective, as robust help is positioned at 23,200. Additional, persistent FPI influx, a bilateral Commerce Settlement between India and the US would supply cushion to the market. We stay constructive on BFSI, IT, defence and textile. Therefore, dips ought to be used as a shopping for alternative in high quality shares with robust earnings.