Inflows in ETFs jumped 74% in April to Rs 19,000 crore. Whereas we maintain speaking about equities and mutual funds, ETFs are steadily gaining recognition among the many buyers due to their low price, liquidity and low volatility. What are the rising traits in fairness ETFs amid tariff scares and geo-political considerations?

The Indian Fairness ETF continues to draw important inflows from numerous units of buyers. Curiously, whereas plain vanilla Change Traded Funds (ETFs) proceed to draw inflows, there’s a rising curiosity in ETFs that concentrate on particular sectors like know-how, healthcare, defence and so forth. These thematic ETFs permit buyers to focus on specific industries which can be anticipated to carry out properly.

Additionally, Good Beta and Issue – Based mostly ETFs that use funding elements equivalent to worth, momentum, or low volatility for index building slightly than conventional market capitalisation, are garnering investor consideration as properly. These traits replicate the evolving panorama of the Indian ETF market, providing buyers a wide range of choices to diversify their portfolios and capitalize on rising alternatives.

World development forecasts are being trimmed down and in that context, would you advocate buyers to decrease their return expectations from equities and therefore go for safer choices just like the fairness ETFs as a substitute of taking inventory choice dangers?

Given the latest downward revisions in world development forecasts, it is comprehensible to think about adjusting funding methods. This surroundings can certainly influence fairness markets, probably resulting in decrease returns. In such a situation, it may be prudent for buyers to mood their return expectations from equities. They could take into account fairness ETFs as they’ll provide an alternate by offering diversification throughout a broad vary of sectors and shares, decreasing the chance related to particular person inventory choice. Alternatively, they’ll take into account Good Beta and Issue-Based mostly ETFs as these ETFs may help seize particular funding elements equivalent to low volatility or high quality, which could carry out in unsure markets.

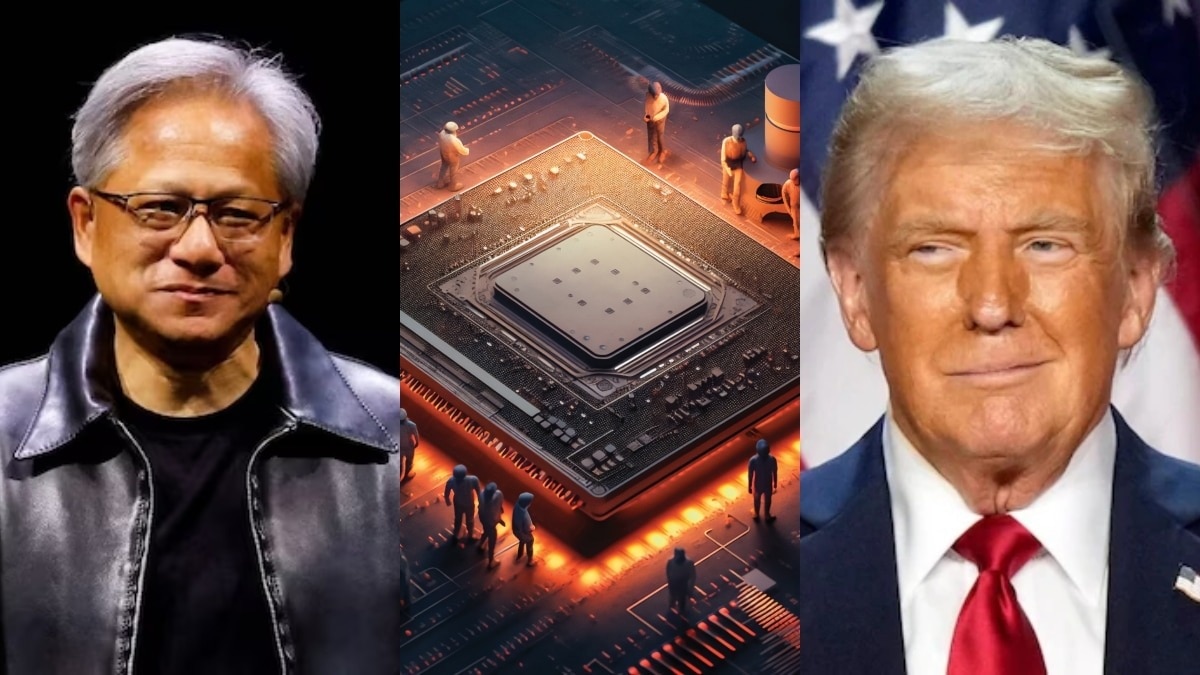

Healthcare and financials have been two themes which have stood out and most ETF schemes having publicity to those sectors have given double-digit returns previously one 12 months. Ought to one proceed investing in each these themes, particularly healthcare provided that the sector stays uncovered to Trump’s tariffs?

Healthcare and financials have certainly been sturdy performers just lately, with many ETFs in these sectors delivering respectable returns. Nonetheless, the potential influence of Trump’s tariffs on the healthcare sector is a sound concern. President Trump’s tariffs might improve prices for healthcare corporations which may have an effect on their profitability. These elevated prices may be handed on to customers or may result in decreased margins for healthcare corporations. Regardless of these challenges, the healthcare sector typically stays resilient because of the important nature of its providers and merchandise. Improvements and an growing old inhabitants proceed to drive demand.

Monetary sector efficiency is carefully tied to financial circumstances. Whereas world development forecasts are being trimmed, the monetary sector can nonetheless carry out properly if home financial circumstances stay secure.Inside financials, would you advocate staying away from ETFs with publicity to PSU banks given their weak efficiency for the final one 12 months or would you continue to guess on them, given that almost all public sector banks (7 out of 12) have reported a very good set of numbers?

PSU banks have had combined efficiency just lately and doubtless could also be too area of interest a class for buyers. Whereas the sector provides balanced risks-reward, a diversified strategy specializing in performers could be helpful. Traders want to observe sector developments carefully to regulate investments accordingly.Between fairness and debt, the place would your cash go as in India we have now already had a few price cuts and within the US we are able to have two this 12 months?

Given latest price cuts in India and potential cuts within the US, a balanced strategy is advisable. Equities provide larger returns however are risky, whereas debt devices present diversification and capital good points with rising bond costs. Traders might look to diversify their portfolio with a mixture of equities and bonds to handle dangers and seize development alternatives. Nonetheless, buyers ought to first seek the advice of an advisor to evaluate a person’s threat profile.

With LIC MF’s three ETFs demonstrating stronger efficiency in comparison with the broader market common over the previous 12 months, are there any plans to launch new ETFs within the close to future?

This displays a strong technique centered on higher execution with a view to minimising monitoring error. Trying forward, LIC MF does wish to be a critical participant within the ETF and Index fund.

(Disclaimer: This disclaimer informs readers that the views, ideas, and opinions expressed within the article belong solely to the creator, and never essentially to the creator’s employer, group, committee, or different group or particular person. The data on this article alone will not be adequate and shouldn’t be used for the event or implementation of an funding technique. Previous efficiency might or is probably not sustainable in future and isn’t a assure of any future returns. Neither the Sponsors/the AMC/ the Trustee Firm/ their associates/ any individual related with it, accepts any legal responsibility arising from using this data.

(Disclaimer: Suggestions, options, views and opinions given by the specialists are their very own. These don’t characterize the views of Financial Occasions)