To have a good time the launch of Millionaire Milestones: Easy Steps To Seven Figures, I need to share the way you would possibly really feel and what you would possibly do as you hit numerous ranges of wealth. Maybe by sharing, I am going to inspire you to take larger motion. We’ll begin with reaching your first million, then transfer on to $5 million, $10 million, and $20 million.

I cease at $20 million as a result of, honestly, when you surpass that threshold, there’s not a lot left you possibly can spend cash on to meaningfully enhance your life-style. Past $20 million, constructing extra wealth merely turns into a sport, a private problem, or an train in greed.

Because the Chinese language thinker Lao Tzu as soon as mentioned, “A journey of a thousand miles begins with a single step.” In the case of constructing wealth, you have to be intentional. Deal with managing your funds with the identical ardour and precision you give to your favourite interest.

Those that wing it should get up a decade from now questioning the place all their cash went. However those that recurrently assessment their funds and put money into their monetary schooling will construct much more wealth than common. And extra importantly, you should have much more freedom to dwell life on their phrases.

1. Reaching Your First Million: Aid, Validation, and a Sense of Actual Chance

Whenever you hit your first million {dollars}, you’ll really feel an amazing sense of aid firstly. You’ll suppose to your self, “Lastly, all these years of saving, investing, and grinding have truly amounted to one thing tangible.” It is an enormous milestone you ought to be pleased with.

It’s like crossing the end line of a marathon the place the prize isn’t only a medal, it’s the flexibility to breathe a bit simpler. You received’t essentially really feel wealthy, particularly because of inflation, however you’ll really feel validated. You’ll understand that as an worker, constructing wealth is not only for different folks or establishments, it’s for you, too.

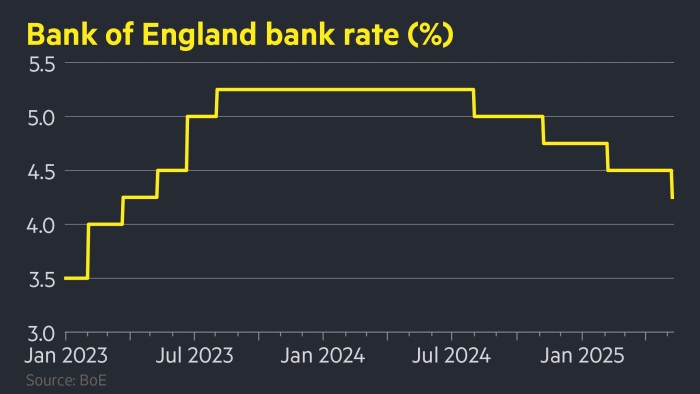

Your first million can even provide you with an enormous psychological unlock. All of a sudden, you’ll see potentialities all over the place. The worry of economic spoil received’t vanish, however it should shrink given you can generate $40,000 – $45,000 a 12 months in passive revenue, risk-free at at present’s rates of interest. You’ll begin to think about what life would possibly seem like if you happen to actually ramp issues up.

Most significantly, the first million is the place you internalize a vital reality: the snowball will get larger by itself. Saving that first $100,000 might need felt like climbing Everest. However upon getting $1 million compounding at 5%–10% a 12 months, you are speaking about $50,000–$100,000 a 12 months in passive development with out lifting a finger.

You’re formally taking part in offense now, not simply protection. You’ll be able to afford to take extra dangers, one thing I want I did extra of once I was youthful.

Frequent Pitfalls Attending to $1 Million:

- Life-style creep: As revenue rises, spending rises even quicker for the undisciplined.

- Funding FOMO: Chasing the following sizzling pattern as an alternative of sticking to a plan.

- Quitting too early: Giving up on saving or investing as a result of the early good points appear too small.

2. Reaching The $5 Million Milestone: Confidence, Choices, and a Style of True Freedom

When you attain the $5 million milestone, a quiet however profound confidence begins to settle in. You not must calculate whether or not you possibly can afford the natural blueberries at Entire Meals. A $7,000 sudden residence restore or perhaps a $50,000 funding mistake that plummets 20% quickly after not appears like an enormous deal.

You additionally begin to understand you may have choices. A $5 million web value can throw off $150,000–$300,000 a 12 months in passive revenue, relying on the way it’s invested. That’s sufficient to exceed the median American family’s whole pre-tax revenue of ~$80,000 with out working one other day in your life.

In case you’ve been caught in a soul-sucking job or run a enterprise that provides you ulcers, $5 million enables you to stroll away. However after all, try to negotiate a severance bundle so you may have an excellent larger monetary cushion once you do. In case you’ve been dreaming of dwelling overseas, working part-time, or beginning your individual enterprise, $5 million offers you the luxurious of selection.

Sadly, you’ll nonetheless fear about your funds.What if the inventory market crashes? What if rental revenue dries up? What if well being care prices explode? However you’ll rationally make contingency plans if any of this stuff occur.

General, your anxiousness will diminish as a result of you recognize you may have true endurance. In a earlier Monetary Samurai ballot, $5 million was the splendid web value to retire with, adopted by $10 million. You might be set for all times if you happen to stay vigilant along with your funds.

Frequent Pitfalls Attending to $5 Million:

- Overleverage: Taking over an excessive amount of debt or buying and selling on margin considering it’s a shortcut.

- Burnout: Pushing too exhausting on the expense of well being, household, and happiness.

- Standing signaling: Overspending on automobiles, houses, watches, and jewellery to “present” you’ve made it. It is fascinating, however a number of the most insecure folks I’ve met are these with web worths across the $5 million mark.

Wanting Again At Retiring With $3 Million In 2012

I left my banking job at age 34 with a web value of roughly $3 million. Adjusted for a 4% compound annual development fee, that’s about $5 million in at present’s {dollars}.

On the time, $3 million felt like sufficient as a result of I solely had myself, and ultimately, my spouse to deal with. My investments had been producing round $80,000 a 12 months in passive and semi-passive revenue. Mixed with a severance bundle and the help of my spouse—who was 31 then and keen to work for an additional three years—I felt it was time to peace out.

Nonetheless, I used to be nervous about leaving my day job so younger. Wanting again, I most likely ought to have labored for an additional three-to-five years to additional solidify my funds.

That mentioned, every part has labored out as a result of I discovered function. I discovered one thing I really like to do this generates supplemental retirement revenue, and, extra importantly, I grew to become a father. Ultimately, retiring early gave me the pliability to construct a extra significant and fulfilling life.

3. Reaching The $10 Million Milestone: Abundance, Standing, and Delicate Shifts in Relationships

On the $10 million milestone, your world view shifts once more. Shortage considering—the nagging perception that there’s by no means sufficient—begins to dissolve, however by no means really goes away.

With $10 million, you will really feel an underlying abundance mindset take over:

- You’ll be able to generously tip service employees with out considering twice.

- You’ll be able to say sure to experiences you as soon as would have handed up due to price.

- You’ll be able to put money into your well being, relationships, and private development with out monetary hesitation.

- You’ll be able to eat wagyu steaks and toro sashimi till you are sick of them each.

- Upgrading to Financial system Plus and even firstclass isn’t any drawback

- Folks do not piss you off as a lot anymore

- Maybe better of all, you possibly can simply communicate your thoughts and arise for your self with out worry of economic spoil

Being A Multi-Millionaire Can Have Its Issues

At this stage, standing turns into extra seen, whether or not you prefer it or not. Folks could deal with you in a different way as soon as they know—or sense—your wealth. Family and friends would possibly ask you for favors, loans, or enterprise investments. You’ll have to develop a thicker pores and skin and clear boundaries.

With $10 million, you will most likely embrace Stealth Wealth like a undercover agent trapped behind enemy traces. You didn’t spend all these years constructing your fortune simply to get hit up for handouts, judged, or peppered with funding pitches each time you permit the home or flip in your laptop computer.

As a millionaire ten instances over, folks shall be faster to guage your actions and much much less sympathetic once you’re feeling down. Regardless that millionaires have emotions and want love too, folks could merely not care if you happen to’re feeling down and out. Therefore, you purposefully develop into extra guarded with your folks and acquaintances.

Fortunately, a few of your relationships will deepen. You may naturally gravitate towards individuals who genuinely do not care about your cash. Now not will you are feeling the necessity to keep relationships simply because somebody holds sway over your monetary or profession future. As a substitute, you will begin surrounding your self solely with folks you really take pleasure in being round.

Having A $10 Million Web Price And Kids

When you’ve got kids, reaching $10 million additionally modifications how you concentrate on legacy. How do you empower your children with out spoiling them? How do you put together them for a world the place they don’t must wrestle financially the way in which you probably did?

FIRE dad and mom would possibly fear much more as a result of they not have conventional day jobs that power them into the workplace 40+ hours every week. A minimum of you probably have a day job and a $10 million web value, your kids will know that you’re working exhausting. Because of this, you’ll probably must make up a “belief fund job” to exhibit your work ethic to your children. In any other case, you would possibly spoil them perspective.

On the identical time, with a lot wealth, it’s possible you’ll naturally begin toying with the concept of making your children millionaires too. You recognize firsthand how exhausting it was to get right here, so it’s solely pure to search for methods to assist them shortcut the journey.

Simply watch out. Taking away your kids’s drive to develop into financially unbiased may find yourself being one of many biggest disservices you do for them.

Frequent Pitfalls Attending to $10 Million:

- Neglecting tax effectivity: At increased wealth ranges, minimizing taxes turns into simply as essential as investing properly.

- Poor property planning: With out good authorized buildings, you danger shedding tens of millions to taxes or probate.

- Not cashing out or diversifying into safer belongings: Outsized revenue and firm valuations don’t final without end. With out diversification, your web value swings will be enormous.

4. Reaching The $20 Million Milestone: Peace, Goal, and a Discount In Materials Wishes

Crossing into $20 million territory feels much less like a serious “occasion” and extra like an arrival. You understand there’s virtually nothing left to purchase that can materially enhance your happiness.

A $50,000 watch received’t make you are feeling higher than a $500 one, so you do not get one. A $200,000 automotive received’t make you happier than a $50,000 one, so that you are inclined to drive your present automotive till it breaks. You would purchase a 3rd or fourth residence, however would you even have time to take pleasure in them? You’ll be able to’t as a result of you possibly can solely dwell in a single place at a time.

The one actual splurges you possibly can take pleasure in with a $20+ million web value are flying personal, renting trip houses for $50,000+ a month, and paying for $60,000+/12 months personal grade faculty with out fear or stress. You would do this stuff with “solely” a $10 million web value too with out, however you will really feel the bills extra acutely.

However even with $20 million, will you actually be keen to spend $120,000 on a roundtrip personal jet flight from San Francisco to Honolulu when 4 first-class seats price simply $10,000? Most likely not. The extra disciplined you’re along with your private funds, the much less probably you’ll be to splurge on such pointless luxuries.

On the $20 million milestone, the actual luxurious turns into time, well being, and relationships.

You begin serious about legacy in a extra profound means:

- How can I make an affect past myself?

- Who can I assist with this abundance?

- What establishments or causes will outlive me?

- Will my kids develop as much as be excellent residents who make one thing of themselves?

Paradoxically, at $20 million, if you happen to’re not cautious, you danger shedding your edge. The starvation that fueled you to work tougher, save extra, and make investments smarter would possibly begin to fade. That’s why having a function past cash turns into so essential.

As well as, as soon as cash is not an issue, all of your different issues come into sharper focus. Uncared for your partner and youngsters in your path to multi-millionaire standing? That remorse could now really feel overwhelming as you possibly can’t get that point again. Prioritized your profession on the expense of your well being? All of a sudden, nothing appears extra essential than getting match so you possibly can dwell longer now that you have received the lottery.

In case you ever attain this stage of wealth, by no means voluntarily inform anybody how a lot you may have. They will guess, however you can not affirm. Your well being and happiness depend upon staying humble and low-key. In case you should share one thing, share your generosity with others.

Your Monetary Fear May Really Enhance Once more

Sadly, a few of you’ll nonetheless fear about cash even at this stage of wealth. In any case, the extra you may have, the extra there’s to lose. A 20% decline may wipe out $4 million to $16 million, which might really feel devastating. That’s why your focus naturally shifts to capital preservation, all whereas making an attempt to outpace inflation.

The principle motive personal investments develop into extra engaging is that you just don’t see the day-to-day volatility such as you do with shares. Along with your cash locked up for five to 10 years, you are inclined to really feel extra at peace.

Frequent Pitfalls Attending to $20 Million:

- Dropping your drive: With out new objectives, it is simple to plateau since no one wants greater than $20 million.

- Isolation: Wealth can unintentionally distance you from outdated associates and even household. Keep grounded, until you proactively search out associates who even have the same stage of wealth.

- May get trapped in a bubble: Your expectations for the best way to spend cash can run fully counter to the 99.5% of the American inhabitants who’ve much less.

Wealth Is Constructed on 1000’s of Micro-Choices

Every millionaire milestone you attain brings a way of satisfaction, but it surely’s the $3 million, $5 million, $10 million, and $20 million marks that are inclined to really feel probably the most important.

None of those emotions—aid, confidence, abundance, pleasure, or peace—occur accidentally. They occur since you took hundreds of intentional steps over years, typically many years.

Keep in mind:

- Each $100 you make investments as an alternative of spend

- Each hour you spend studying and creating as an alternative of mindlessly consuming

- Each danger you’re taking to stage up your expertise or profession

All of it provides up.

Constructing wealth is an easy method, but it surely’s not straightforward to keep up over the long term. It’s about self-discipline, persistence, and imaginative and prescient. If you wish to create a lifetime of freedom for your self—and to your kids—you need to determine at present to take step one.

Decide Up A Copy Of Millionaire Milestones At present

As I wrote in Millionaire Milestones: Easy Steps To Seven Figures, “If the path is right, ultimately you’ll get there.”

Good luck in your monetary journey. If you wish to develop into a millionaire or multi-millionaire, my e book will aid you get there. You’ll be able to decide up a duplicate on Amazon, Barnes & Noble, Books A Million, Bookshop.org, or anyplace you prefer to buy books.

For these of you who’ve reached these millionaire milestones, how did you are feeling after hitting each? Which monetary milestone had probably the most lasting affect in your life-style and happiness? I’d love to listen to your story—what modified for you, and what did you do in a different way afterward?

Subscribe To Monetary Samurai

Hear and subscribe to The Monetary Samurai podcast on Apple or Spotify. I interview consultants of their respective fields and focus on a number of the most fascinating matters on this web site. Your shares, scores, and opinions are appreciated.

To expedite your journey to monetary freedom, be a part of over 60,000 others and subscribe to the free Monetary Samurai e-newsletter. Monetary Samurai is among the many largest independently-owned private finance web sites, established in 2009. Every part is written primarily based on firsthand expertise and experience.

How You may Really feel Reaching Numerous Millionaire Milestones ($1-$20M) is a Monetary Samurai unique put up. All rights reserved.