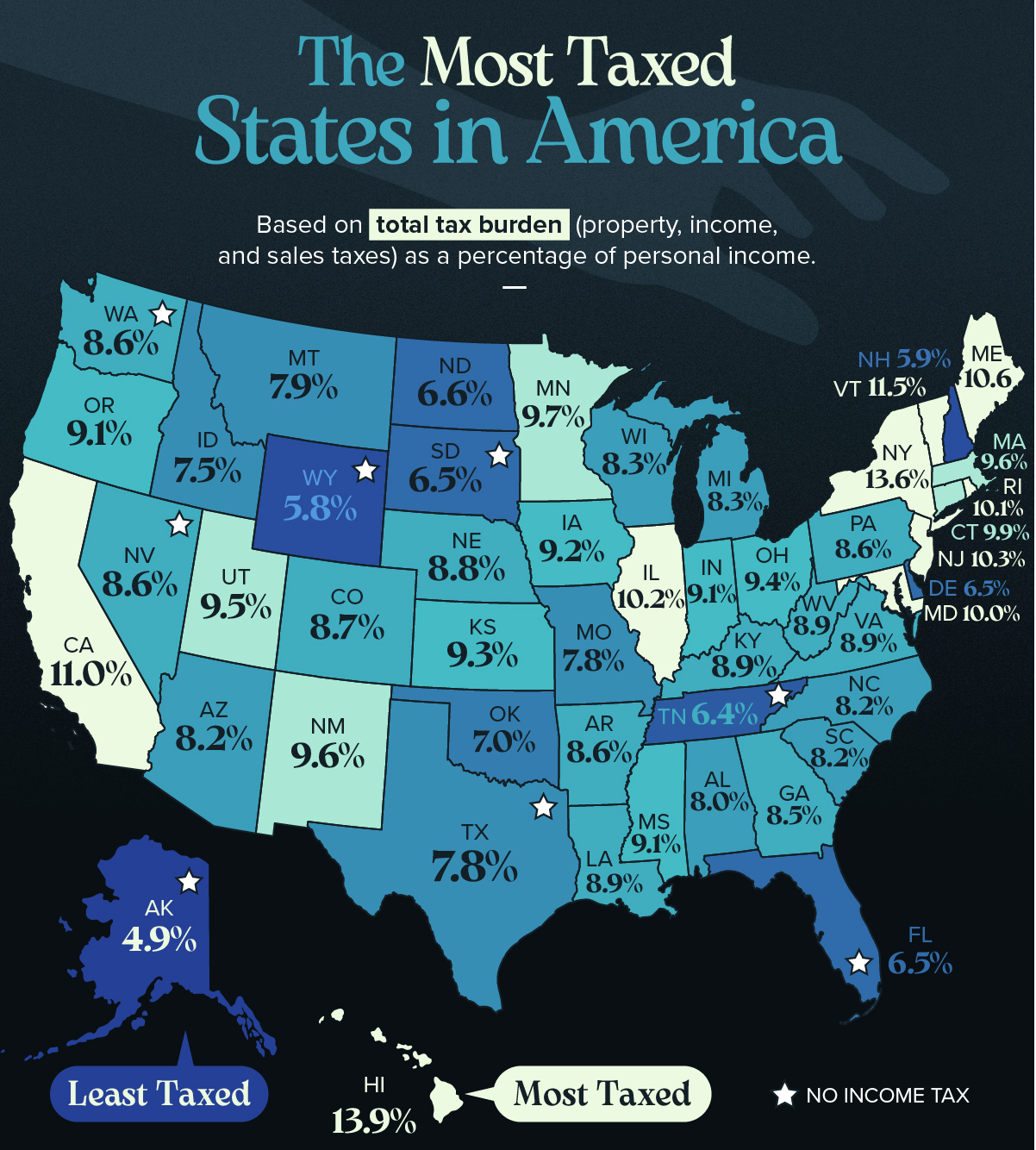

Once you consider taxes, you most likely consider federal revenue taxes first. However state taxes can add up!

Reply:

Most taxed: Hawaii at 13.9%

Least taxed: Alaska at 4.9%

Questions:

- How does your state evaluate? What’s your state tax charge?

- How a lot would you think about state taxes when deciding the place to stay? Why?

- What applications/companies are funded with state taxes?

Listed below are the ready-to-go slides for this Query of the Day that you need to use in your classroom.

Behind the numbers (Visible Capitalist):

Hawaii holds the best whole tax burden in the USA, with residents contributing almost 14% of their revenue to state and native governments. This consists of 4.2% in revenue taxes, 2.6% in property taxes, and a considerable 7.2% in gross sales and excise taxes.

In distinction, Alaska has the bottom general tax burden. Residents there pay no state revenue tax, solely 3.5% of their revenue in property taxes, and simply 1.5% in gross sales and excise taxes—leading to a complete tax burden of solely 4.9%.”

About

the Creator

Kathryn Dawson

Kathryn (she/her) is happy to hitch the NGPF staff after 9 years of expertise in schooling as a mentor, tutor, and particular schooling instructor. She is a graduate of Cornell College with a level in coverage evaluation and administration and has a grasp’s diploma in schooling from Brooklyn Faculty. Kathryn is wanting ahead to bringing her ardour for accessibility and academic justice into curriculum design at NGPF. Throughout her free time, Kathryn loves embarking on cooking tasks, strolling round her Seattle neighborhood along with her canine, or lounging in a hammock with a e-book.