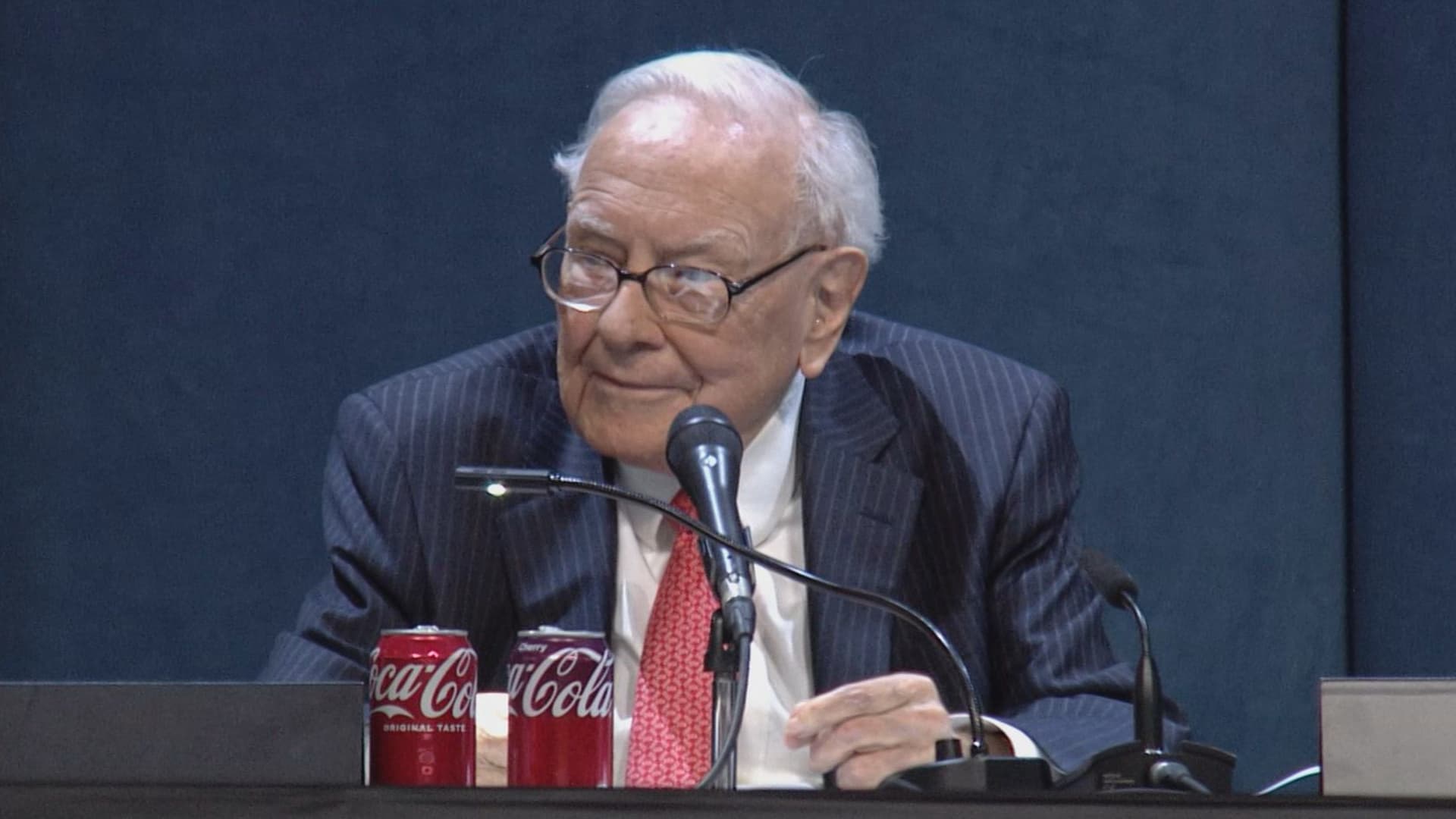

OMAHA, Nebraska — Warren Buffett on Saturday disregarded latest inventory market volatility that has rattled buyers over the previous a number of weeks.

“What has occurred within the final 30, 45 days … is absolutely nothing,” the Berkshire Hathaway CEO stated in the course of the conglomerate’s annual assembly.

Buffett identified that there have been three events over the past six a long time the place Berkshire Hathaway inventory declined 50%. He famous that there was no elementary subject with the corporate throughout these intervals.

On condition that, he stated the U.S. inventory market’s latest motion shouldn’t be characterised as a “big” transfer.

“This has not been a dramatic bear market or something of the kind,” Buffett stated.

S&P 500, YTD

These feedback from the “Oracle of Omaha” as buyers surprise what’s subsequent for markets after the wild buying and selling seen amid considerations over President Donald Trump’s contentious tariff coverage introduced in early April.

The S&P 500 on Friday notched its longest successful streak since 2004 as Wall Road claws again losses seen within the preliminary sell-off following Trump’s preliminary coverage unveiling. It marks a surprising rebound for U.S. shares after the benchmark index at one level entered a bear market on an intraday foundation final month, a time period used to explain a fall of greater than 20% from its latest excessive, earlier than regaining floor.

Buffett stated different intervals have been “dramatically completely different” than the present one dealing with buyers. He reminded buyers that the market has climbed over the 94-year-old’s lifetime, whereas cautioning that they should be prepared for bouts of troublesome motion.

He shared that the Dow Jones Industrial Common sat at 240 on his birthday of Aug. 30, 1930, and fell as little as 41. Regardless of “hair-curler” occasions he is lived by means of, the blue-chip common completed Friday above 41,300.

“If it makes a distinction to you whether or not your shares are down 15% or not, you have to get a considerably completely different funding philosophy,” Buffett stated. “The world isn’t going to adapt to you. You are going to must adapt to the world.”

“Folks have feelings,” he added. “However you bought to test them on the door whenever you make investments.”