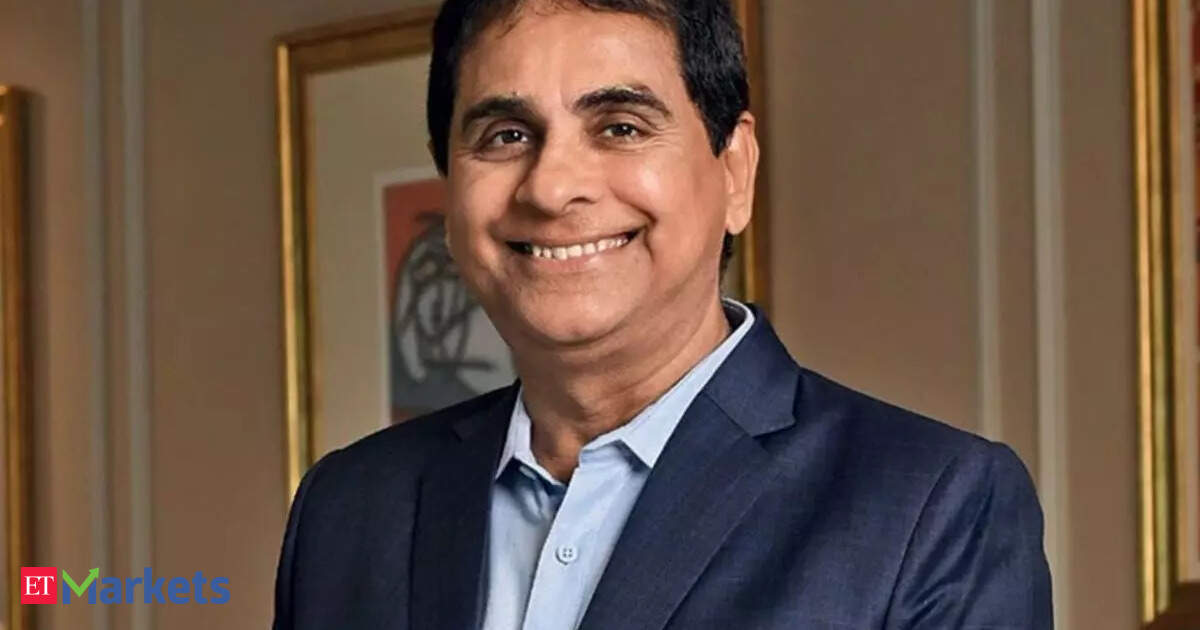

“F&O was meant for hedging, not hoping — however retail is popping the market right into a on line casino. Possibly it’s time we ask: ought to entry include a license, not only a login?” Kedia stated.

The capital markets regulator Sebi has additionally repeatedly flagged the excessive failure charge in F&O buying and selling, noting that over 90% of retail merchants lose cash on this phase. It has mandated brokers to show outstanding danger warnings on their platforms concerning F&O buying and selling.

“Over 90% of retail merchants lose cash in F&O. This isn’t danger administration — it’s simply playing, masked as technique. We could name it a hedge, however the information calls it a warning,” Kedia added.

A examine revealed that between FY22 and FY24, 93% of particular person merchants within the fairness F&O phase incurred losses, totaling Rs 1.8 lakh crore. The typical loss per dealer stood at Rs 2 lakh, whereas only one% managed to earn earnings exceeding Rs 1 lakh after accounting for transaction prices.

In response, Sebi has launched a collection of regulatory measures aimed toward curbing speculative retail buying and selling within the F&O phase. These embrace elevating the minimal contract dimension for index derivatives to Rs 15 lakh and limiting weekly expiries to 1 per alternate.Moreover, an excessive loss margin (ELM) of two% has been imposed on brief index choices contracts on expiry days. These steps type a part of a broader effort to boost investor safety and guarantee market stability.In line with reviews, Sebi can be contemplating a ‘suitability take a look at’ for retail F&O merchants. The proposed measure would require merchants to reveal a transparent understanding of the dangers related to derivatives buying and selling—doubtlessly by way of obligatory exams or by assembly minimal earnings and capital thresholds.

Kedia had earlier highlighted the psychological entice that many retail buyers fall into—believing they will rapidly construct capital by way of F&O buying and selling earlier than transitioning to long-term investing.

(Disclaimer: Suggestions, options, views and opinions given by the specialists are their very own. These don’t characterize the views of The Financial Occasions)